Most parents dream of giving their children a joyful and fulfilling childhood. Beyond that, many hope to provide a strong financial foundation that supports their children as they build families of their own. Traditionally, this might mean leaving behind an inheritance.

However, as approximately 70%* of first-time homebuyers in large urban centers stated in 2023 that they’re worried about not having a large enough down payment to buy the home they want, “someday” can feel more like a missed opportunity than an assurance.

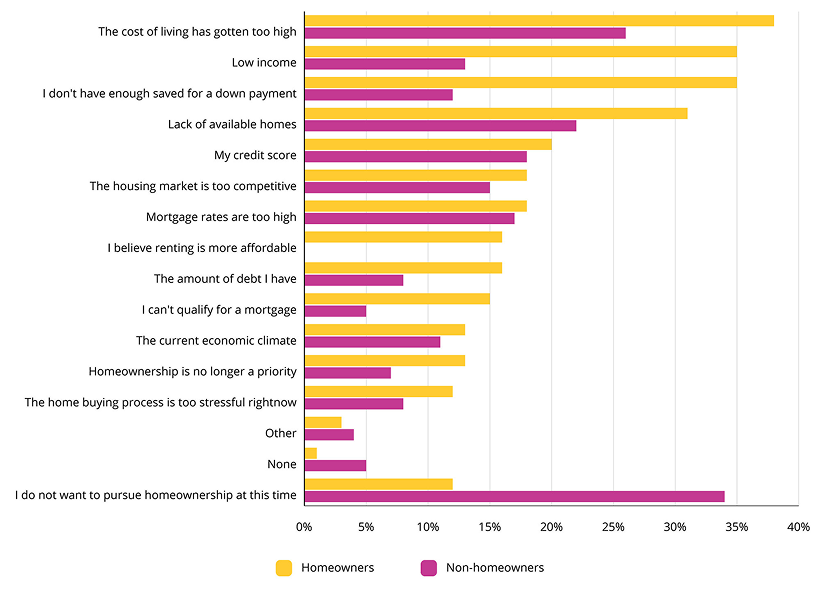

Nationwide statistics support this, with the overall cost of living and homeownership only continuing to rise: 38% of non-homeowners cited a high cost of living as a preventative reason from purchasing a home**. What’s more, in February 2025, mortgage inflation increased by 9%, compared to the same month last year, while rent inflation increased by 5.8%1.

With financial stress and uncertainty on the rise, why not consider a reverse mortgage to help your children with a gifted down payment today, rather than passing down wealth later in life? A reverse mortgage empowers parents to provide a living inheritance and give their children meaningful financial support, when it can truly make a difference2.

Obstacles preventing Canadians from buying a home at this time

Source: https://www.nerdwallet.com/ca/p/article/mortgages/2025-canadian-home-buyer-report

What is a living inheritance?

It’s a way for parents to share their wealth with their children while they're still alive, rather than wait to pass it down through a traditional estate. It allows families to benefit from financial support during key life stages, like buying a first home, raising children, or starting a business—stages when that help can be most impactful.

What is a reverse mortgage?

An Equitable Bank Reverse Mortgage is a type of loan that allows homeowners to access up to 59% of their home’s equity without selling their home, in the form of Internal useable tax-free2 cash. Unlike traditional mortgages, there are no monthly payments to worry about, making it a practical option for retirees on a fixed income. The funds that are received are tax-free2 and can be taken as either a lump sum or in regular advances. Your obligations are that you maintain the property, pay your property taxes, and keep your homeowners’ insurance current.

The main benefit of a reverse mortgage is that the balance is only due in the event that you sell, transfer, move to a senior home, pass away or default, subject to certain conditions. When your home is eventually sold, the proceeds go toward settling the loan balance, and what’s left over is yours or your heirs to keep.

What does this mean for you, and how can a reverse mortgage help?

Gifting your children a living inheritance can help them achieve their goals today—and you get to witness and share in their relief, gratitude, and joy.

As you grow older, you realize your most valuable asset holds much of what you’ve worked so hard to build: equity.

This equity represents real financial power. It can support your retirement and help secure your children’s future. That’s where the reverse mortgage comes in. It allows homeowners like you to unlock a portion of their home’s value, tax-free2, and use it in a way that truly matters, like gifting their children a living inheritance, offering support when they need it most.

Learn more about how a reverse mortgage works.

Is a reverse mortgage a good idea?

It may be for you! You’ve worked hard to build equity in your home. You should be able to access it.

Flexible options allow you to choose how you receive your funds—whether you prefer a larger lump sum or monthly installments, you can determine what works best for you.

No impact on federal retirement benefits. The tax-free2 cash you receive from your reverse mortgage does not impact federal retirement benefits, such as CPP and OAS. This means stress-free access to cash without having to worry about your other benefits being impacted.

Protect your retirement savings by using the equity you’ve already built in your home using a reverse mortgage, instead of tapping into your investments, which could also trigger tax implications2. Let your investments work for you, without having to draw them down earlier than you need to.

Stay in the home you love. With a reverse mortgage, you retain 100% ownership of your home3, giving you peace of mind, while you pay off any outstanding debt. Once debts are cleared, many reverse mortgage holders have money left over to put toward enjoying retirement the way they hoped.

To read more about how a reverse mortgage could benefit you and your family, visit our blog post on reverse mortgage pros and cons.

How do I qualify for a reverse mortgage?

It’s simple. You may qualify if you:

- Are a homeowner aged 55 years or older

- Live in an eligible city or large town in British Columbia, Alberta, Ontario or Quebec

- Live in your principal residence for at least six months per year

- Are the title holder of the residence

How much equity can I access from my home?

Use our free, easy-to-use calculator to help you determine how much cash you can access—with no obligation. From there, you can reach out to our team for more support.

As a Canadian homeowner, you’ve worked hard for the equity in your home and deserve to see your children achieve the same success you have.

An Equitable Bank Reverse Mortgage may be the solution to help you unlock financial freedom for yourself and your heirs.

Want to hear what a real customer has to say?

For clients like Barbara4, it’s not just about money—it’s about family. With a reverse mortgage, she got to witness her daughter buy her first home and play a large role in their future stability.